Fed Slows Pace of Rate Increases as Expected

December 14, 2022

As expected, the Federal Reserve voted today to raise its target for short-term interest rates by 50 basis points at its final meeting of the year. This decision comes after 75 basis point increases at each of the four previous meetings. While this is a moderation in the pace of rate hikes, it is still, in the words of Federal Reserve Chair Jerome Powell, "historically large." The Fed Funds rate has been increased by a cumulative 425 basis points this year, the most since 1980, taking the target range for the Fed Funds rate is now between 4.25 and 4.5 percent.

The decision to raise rates by half a percentage point was not a surprise. The economic data released since the last Fed meeting and policymakers' public comments suggested this was the most likely outcome. The interest leading up to the meeting was in the Summary of Economic Projections. This round of projections was decidedly more hawkish than those issued following the September meeting. For instance, the median estimate for the year-end 2023 Fed Funds rate increased from 4.6 percent to 5.1 percent. The median projections for 2024 and 2025 were also revised higher by 20 basis points to 4.1 percent and 3.1 percent, respectively.

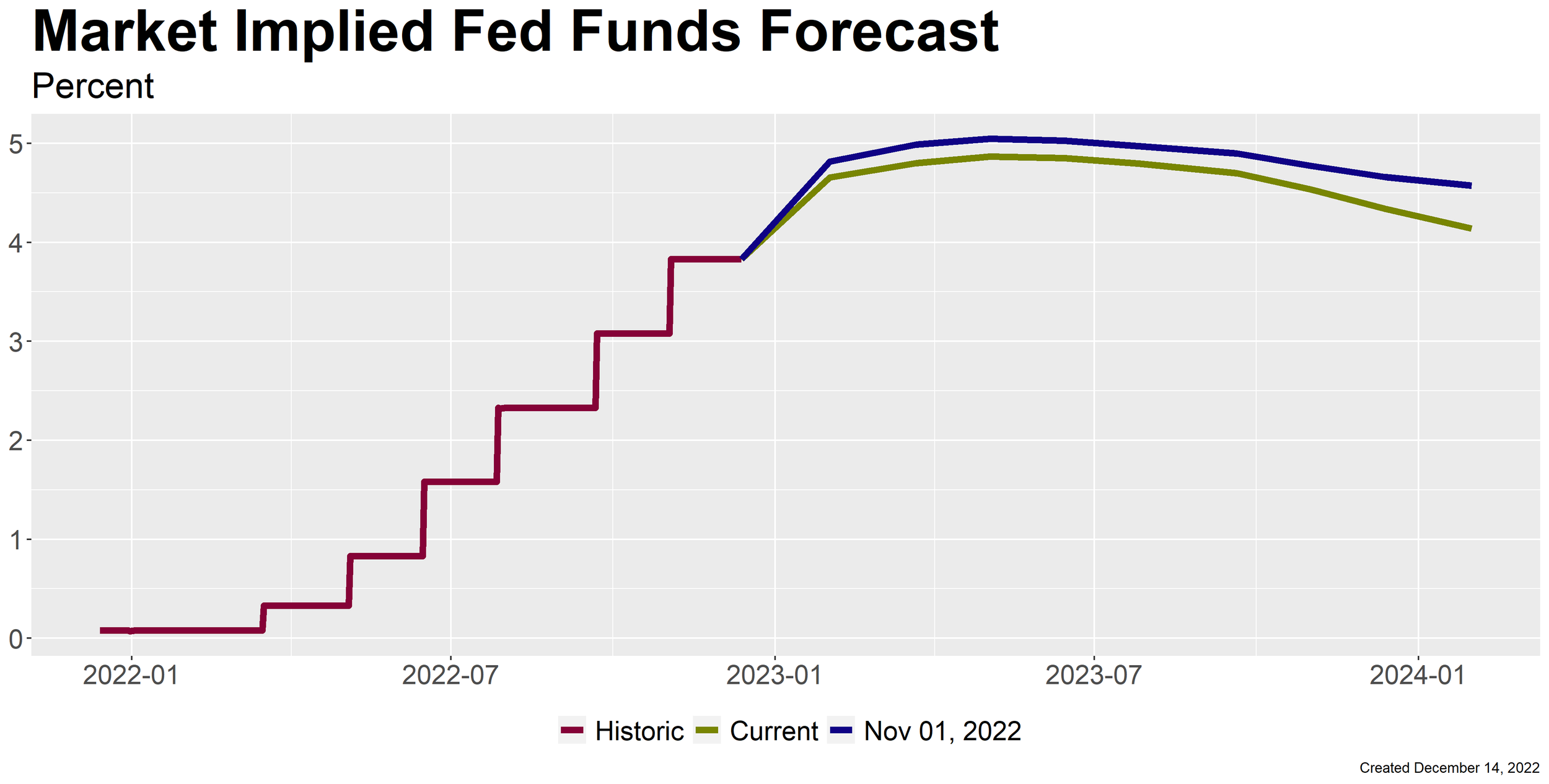

These rate projections are at odds with the path of rate increases implied by the market. Futures markets suggest an increase in the Fed Funds rate to less than 4.9 percent by mid-year, followed by a quick transition to interest rate cuts in the second half of the year, with rates ultimately ending 2023 below 4.4 percent. The Fed has communicated that it intends to hold interest rates at a "sufficiently restrictive" level for "some time." Still, the market continues to doubt either the Fed's resolve or the need to keep rates in restrictive territory amid expectations for weaker economic growth.

The committee's median projection for economic growth next year was lowered to 0.5 percent, down from 1.2 percent in September's forecasts. Meanwhile, the committee expects the unemployment rate will rise to 4.6 percent by the end of next year and hold at that level in 2024. Of course, when the Fed moves away from restrictive policy to support economic growth and the labor market largely depends on the path of inflation. The median estimate sees PCE inflation falling from 5.6 percent this year to 3.1 percent next year and 2.5 percent in 2024. If inflation falls faster than forecasted in early 2023, it could be enough for the Fed to pivot policy sooner than they currently expect. In the meantime, policymakers may use their public comments in the weeks ahead to bring markets into line with their current outlook.

David Allen, CFA, CFP

Chief Investment Officer

DISCLAIMER

The information provided in our news and articles section is provided for informational purposes only. It is educational in nature and is not meant to be a recommendation for any specific investment or a substitute for specific individualized legal or tax advice. None of PAM’s representatives are suggesting that the reader take a specific course of action. Prior to making any investment or financial decision, an investor should seek individualized advice from personal financial, legal, tax, and other professionals. As a reminder, opinions and statements concerning market trends in our blog are based on current conditions and are subject to change without notice.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments. Additionally, because of its narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies. Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

All images of people, if any, presented in this article do not reflect any clients, and no compensation was provided to these individuals for the use of their image; it is not known if these persons, if any, are familiar with PAM or would endorse our services.