Three Takeaways from the September Fed Meeting

September 22, 2022

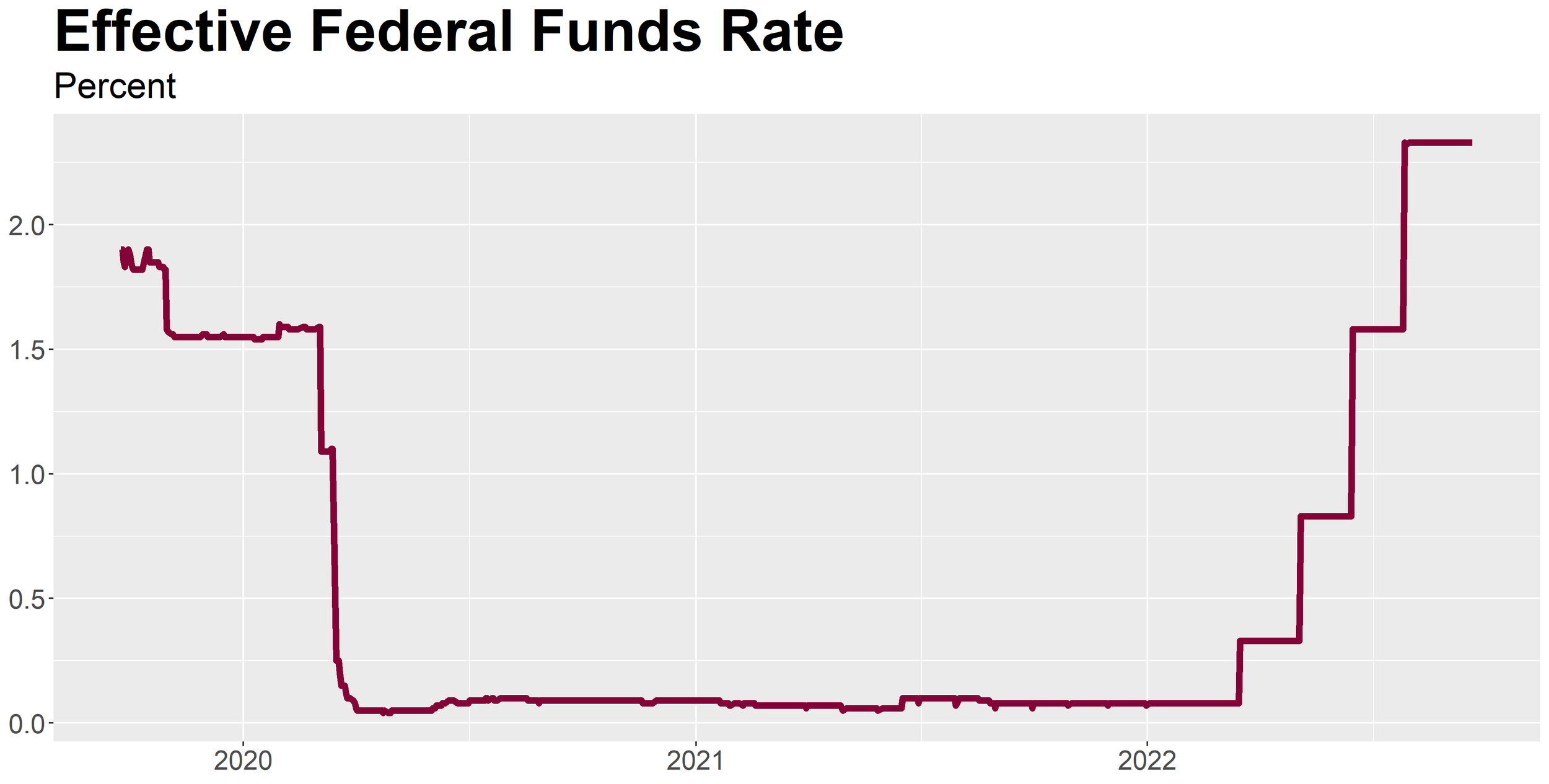

As expected, the Federal Reserve voted unanimously yesterday to increase the target Fed Funds rate by 75 basis points. This was the third consecutive meeting where policymakers have increased rates by three-quarters of a percentage point.

The consistency in the pace of rate increases over the summer obscures just how remarkable this period of tightening has been. Before the last three meetings, the Federal Reserve had increased rates by 75 basis points just once in the last thirty years. After beginning the year at the zero lower bound, the Fed Funds target range is now between 3 and 3.25 percent. The last time the target policy rate exceed this level was January 2008.

Short-term interest rates and the Dollar moved higher after the announcement and US equity markets ultimately finished the day at session-lows. We will have to wait to determine the full market reaction to today’s news, but we have three immediate takeaways.

Additional 125 Basis Points of Rate Increases Are Likely This Year

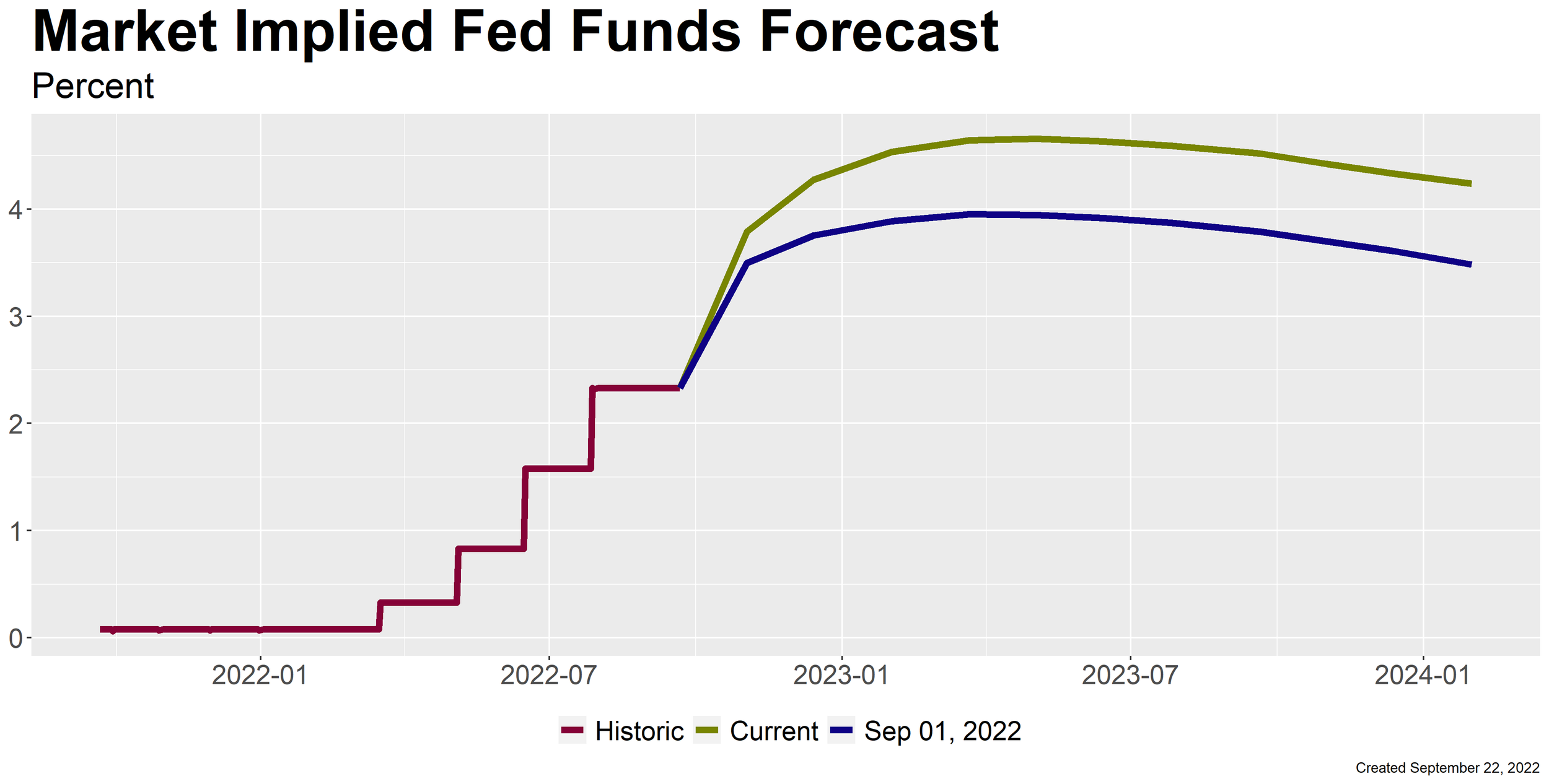

We believe the tone of the Fed’s communications yesterday was decidedly hawkish. There is arguably no better example of that than the median projection for the Fed Funds rate at the end of 2022, which increased to 4.4% from 3.4% in the last set of economic projections released in June. This implies that over the two remaining meetings this year (on November 2 and December 14), the committee will increase interest rates by an additional 125 basis points.

This is about 25 basis points more than markets expected earlier this week and 75 basis points more than expected at the beginning of September. We think this makes a 75 basis point increase at the November meeting followed by a 50 basis point increase in December the base case.

We should note that projections of individual policymakers indicate that the committee is a bit less aggressively-minded than the median alone would suggest. Policymakers were nearly evenly split into two camps. Nine policymakers expect a year-end policy rate of 4.125% or less (Group A), while ten expect a rate of 4.375% or more (Group B). The median projection ultimately fell into Group B, but it was obviously very close.

Even so, we still feel that 125 basis points is most likely. During his press conference Federal Reserve Chairman Jerome Powell did not highlight this nearly even split, which suggests to us that he is part of Group B and did not want to suggest that 100 basis points of further tightening this year was more likely than the median projection would suggest.

Policymakers’ Economic Outlook is More Realistic

One of our major criticisms of the Fed in recent months was that the June Summary of Economic Projections were far too optimistic about the impact tightening monetary policy would have on the rest of the economy. In the updated set of forecasts the committee has moved closer to an outlook we think is realistic.

For instance, the median forecasts for GDP growth through 2024 were all lower than in the June projections. The committee now sees just 0.2 percent growth in the economy this year, down from 1.7 percent, and 1.2 percent growth in 2023 instead of 1.7%.

Similarly, the labor market is now expected to weaken more significantly as the economy slows. The median forecast now sees the unemployment rate rising from 3.8 percent at the end of this year to 4.4 percent at the end of 2023, well above the 4.0 percent estimate of full employment.

That said, while these projections are more realistic they are probably still too rosy. For PCE inflation to fall from 5.4 percent to 2.8 percent during 2023, as the median forecast suggests, we believe it would require both a contraction in the economy and a more significant weakening in the labor market.

The Committee is Prepared to Do Whatever it Takes

Powell has been consistent in his messaging over the last few months: high inflation is the biggest risk to the economy and the committee will do whatever is required to bring inflation back to the two percent target. Despite his consistency, the market has looked for signs that the Fed is pivoting to a more dovish policy stance. This tends to mean an easing of financial conditions, which works against the Fed’s efforts to slow the pace of inflation.

Powell’s succinct comments at the Jackson Hole Economic Symposium last month intended to remove any ambiguity about the Fed’s commitment to returning inflation to target. Then today, during his press conference when discussing whether the economic conditions presented in the committee’s outlook would be sufficient to achieve the 2 percent target, Powell said this:

The message here is clear. Regardless of what their outlook is today, based on the incoming data the committee will take whatever action is necessary to send inflation back to target. This is the most hawkish we have heard Powell during his time as Fed Chair and a message we expect other members of the committee to reinforce in their public comments ahead of their next meeting on November 1-2.

David Allen, CFA, CFP

Chief Investment Officer

At PAM, we use our blog as a communication tool that is provided for informational purposes only. It is educational in nature and is not meant to be a recommendation for any specific investment or a substitute for specific individualized legal or tax advice. None of PAM’s representatives are suggesting that the reader take a specific course of action. Prior to making any investment or financial decision, an investor should seek individualized advice from personal financial, legal, tax, and other professionals. As a reminder, opinions and statements concerning market trends in our blog are based on current conditions and are subject to change without notice. Additionally, because of its narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies.

PCE Inflation is a measure of the prices of goods and services purchased by consumers in the U.S and is issued by the Bureau of Economic Analysis.