Job Growth Continues to Exceed Expectations in February

March 10, 2023

This morning’s Employment Situation report for February showed, once again, that job growth increased more than expected. Nonfarm payrolls increased by an estimated 311,000, easily exceeding the 225,000 consensus estimate. Remarkably, this is the 11 consecutive month that the change in payrolls has exceeded expectations, the longest streak in data dating back to 1998. Though payroll growth in excess of 300,000 is very strong from a historical perspective, growth slowed markedly from the revised 504,000 increase in January. This is the biggest decline in payroll growth from one month to the next since August 2022. This moderation in the pace of payroll growth will be viewed favorably by the Federal Reserve.

So, too, will the increase in the headline unemployment rate from 3.4 percent to 3.6 percent in February. Though this is still well below what we consider full employment, it suggests that labor market conditions loosened a bit. Importantly, the increase in the unemployment rate was driven by an increase in the size of the labor force. The labor force has now increased in each of the last three months by an average of 575,000 and the labor force participation rate is the highest since March 2020. This is a great sign from the Fed’s perspective.

Among the Fed's biggest concerns at this stage of their fight against inflation is wages growing too quickly and creating what’s called a wage-price spiral. One of the ways to slow wage growth is to increase the supply of labor, and this labor force data suggests this already underway. It’s likely that some of the factors that kept working-aged people out of the labor force – health concerns, trouble finding childcare, and high savings balances, for instance – are dissipating. If the labor force continues to grow, it would exert some disinflationary pressure on the economy.

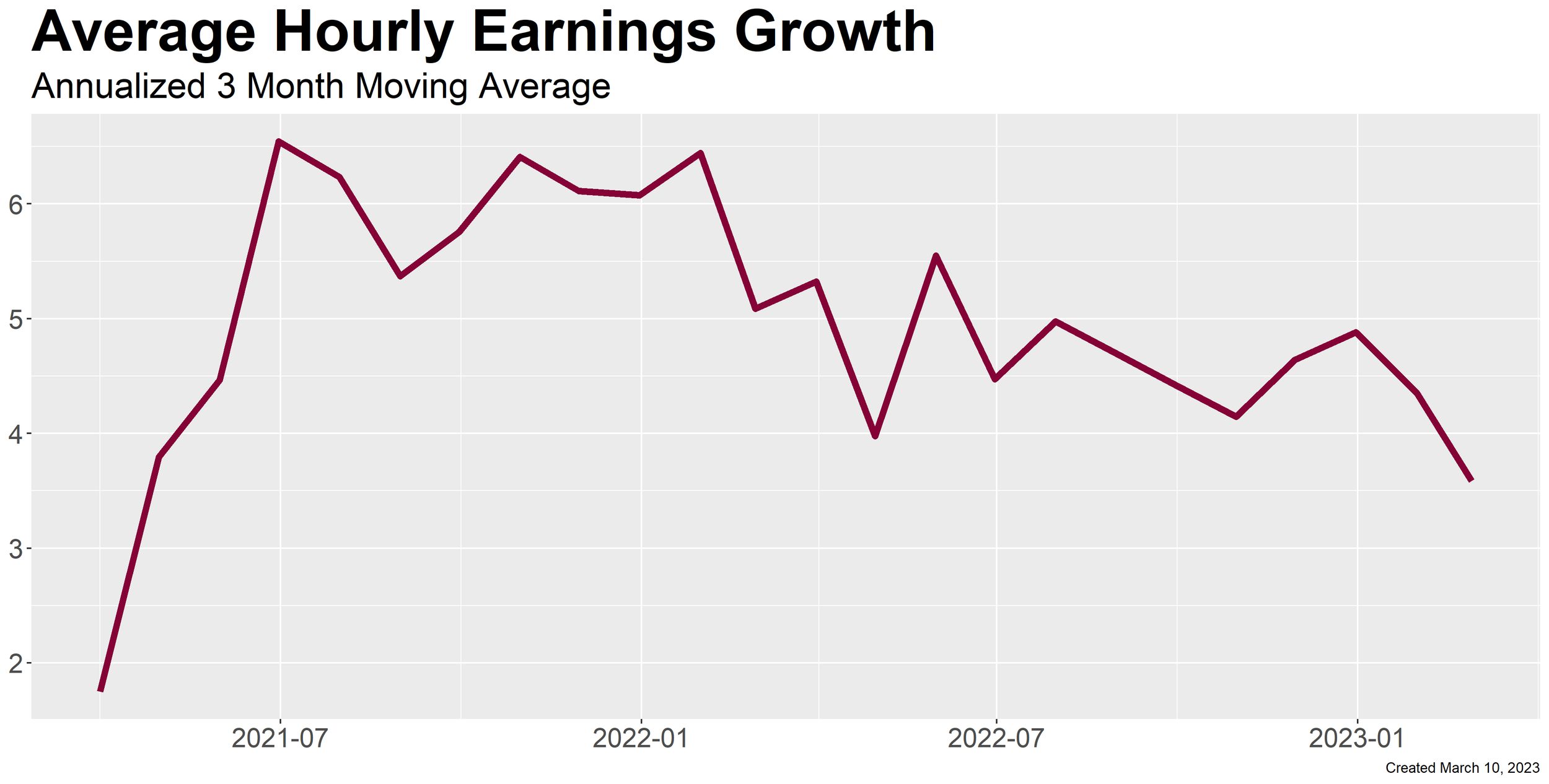

While it still too early to say for sure, the February data suggests that those disinflationary forces are already forming. Average hourly earnings increased just 0.2 percent month on month, the slowest pace of growth in 12 months. Year on year growth accelerated slightly due largely to base effects but was still below the consensus expectation. We think a better indicator of the underlying trend is the annualized three-month moving average of earnings growth, which slowed to 3.6 percent from 4.9 percent in December. This is close to the 3.3 percent average year on year change we saw in 2019.

We would caution interpreting today’s equity market performance as a reaction to the jobs data. Trading may have been a reaction to the collapse of Silicon Valley Bank and broader concerns about financial stability. On other hand, market implied forecasts for the Fed Funds rate suggest indicate a belief that this morning’s data has marginally reduced the likelihood of a 50-basis point rate increase at the Fed’s next meeting later this month. Also, the implied terminal rate of the Fed’s hiking cycle has fallen more than 50 basis points over the last two days to 5.17 percent. We do not believe this jobs data settles the debate on what action the Fed will take at its next meeting, however, as next week’s CPI data also has the potential to shift market expectations.

David Allen, CFA, CFP

Chief Investment Officer

DISCLAIMER

The information provided in our news and articles section is provided for informational purposes only. It is educational in nature and is not meant to be a recommendation for any specific investment or a substitute for specific individualized legal or tax advice. None of PAM’s representatives are suggesting that the reader take a specific course of action. Prior to making any investment or financial decision, an investor should seek individualized advice from personal financial, legal, tax, and other professionals. As a reminder, opinions and statements concerning market trends in our blog are based on current conditions and are subject to change without notice.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments. Additionally, because of its narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies. Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

All images of people, if any, presented in this article do not reflect any clients, and no compensation was provided to these individuals for the use of their image; it is not known if these persons, if any, are familiar with PAM or would endorse our services.